India’s Non-Life Insurance Industry Set for 8–10% Rate Hike

India’s non-life insurance industry is set for a significant shift when it comes to pricing as the insurers are set to implement average rate hikes ranging from 8% to 10% over a number of classes of business in the upcoming months. This action follows a global trend at the industry level in insurance businesses across the world, driven by predominantly spiraling reinsurance premiums, shifting exposure to risk and increasing severity in claims.

Industry experts are citing a convergence of factors that are compelling insurers—particularly in the property and casualty segments—to reconsider their underwriting and pricing strategies to ensure long-term profitability and sustainability.

Raising Rates Across Key Non-Life Insurance Segments

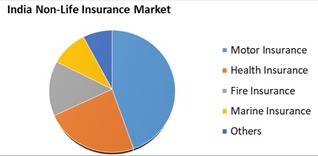

The next round of price action is going to have implications on many lines of insurance, particularly property, marine, motor, and third-party liability insurance. These represent the cornerstone of non-life insurance business in India and are highly sensitive to domestic and global risk trends.

Property insurance, protecting commercial properties, factories, warehouses, and infrastructure plans, is expected to post one of the highest hikes. This is based on increased exposure to urban fire hazards and cataclysmic weather losses, both of which have been among the drivers responsible for a recent rise in payments.

Similarly, sea insurance covering cargo and transit risks is experiencing increasing losses due to the disruption of global supply chains, geopolitical tensions, and increasing instances of piracy. Motor insurance, especially third-party liability, is also being redesigned as accident numbers rise and judicial liabilities become increasingly complex and expensive to settle.

Reinsurance Expenses at the Core of the Non-Life Insurance Spike

At the center of the rate increases is a sharp increase in reinsurance costs—a primary element of the insurers’ risk transfer mechanism. Reinsurance rates for property and casualty treaties have been increasing by 40% to 60% in recent renewals, forcing primary insurers to reassess their pricing models in order to preserve margins.

Reinsurance is a financial buffer for insurers as it allows them to transfer enormous risks to foreign reinsurers in exchange for a premium. If such reinsurance premiums rise, the cost automatically passes on to policyholders.

In India, the process works well, as particularly many of the insurers rely heavily on foreign reinsurance protection for large-ticket industrial and infrastructure risks. When global reinsurers slow up capacity and increase rates to cover their own losses, Indian insurers do not have any choice but to increase rates.

Global Events Driving Volatility in Non-Life Insurance Reinsurance

The steep increase in reinsurance costs is not alone. It is the culmination of several years of rising global losses, fueled by a combination of geopolitical wars and natural disasters.

One of the most significant events is the Russia-Ukraine warglobal, causing record insured losses in the aviation, energy, and political risk classes. The conflict also increased uncertainty and created a re-risking of perils in Eastern Europe and elsewhere and contributed to an effect on worldwide underwriting appetite.

Moreover, a growing number of natural disasters—from floods and cyclones to fires and earthquakes—have cost the reinsurance business trillions of dollars. As climate change intensifies the severity and frequency of weather events, reinsurers face the pressure to be able to deliver capital adequacy as well as risk-based pricing.

These compounding conditions have pushed the global reinsurance market into what is being framed by most observers as a “hard market” phase of rising premiums, higher terms, and reduced coverage ceilings.

Implications of Non-Life Insurance Rate Hikes for Indian Stakeholders

For Indian insurers, the short-term challenge is to balance profitability without weakening affordability and accessibility substantially for customers. Most insurers are treading a tightrope between taking some of the reinsurance increase on their books and transferring it onto customers through rate increases.

More diversified, larger insurers with stronger balance sheets can buffer some of the cost increases, but smaller and medium-sized companies may need to increase rates more sharply or shed their exposure to higher-risk segments.

For policyholders—especially large commercial property and marine coverage demand enterprises—the upcoming changes may translate into substantial premium outgo hikes. Corporate buyers and risk managers will be obliged to re-evaluate their coverage requirements, explore risk mitigation alternatives, and bargain for harder policy terms.

Embracing Risk-Based Underwriting in Non-Life Insurance

current situationWhile rising premiums may be inconvenient for customers, the situation presents an opportunity for Indian insurers to embrace more risk-based underwriting, according to insurance professionals. Historically, the Indian non-life insurance market has been marked by price war and commoditization with little policy differentiation.

As costs rise, insurers can now develop more sophisticated underwriting models based on granular risk data, location-based exposures, and policyholder behavior. Usage-based insurance (UBI) models, predictive analytics, and AI-driven risk evaluations are increasingly being explored to deliver more personalized and profitable insurance offerings.

Regulatory Support Ensuring Non-Life Insurance Market Stability

The Insurance Regulatory and Development Authority of India (IRDAI) has also been a major supporter of market stability via price discipline and measures of capital adequacy. IRDAI’s emphasis on solvency regulations and risk-based capital enables the insurers to be adequately prepared to counter the volatile reinsurance climate.

In addition, the regulator has been encouraging innovation and digital transformation, which can help insurers to process claims better, curb fraud, and operate more efficiently—each of which is critical to containing costs in a high-rate environment.

Growth Opportunities Ahead for India’s Non-Life Insurance Sector

Despite the near-term stresses of increasing costs and hardening reinsurance prices, India’s non-life insurance industry long-term perspective remains strong. The market is still underpenetrated with enormous scope to expand in the health, motor, cyber, and liability lines.

As the economy expands, infrastructure investments rise, and insurance awareness increases, demand for sophisticated risk transfer solutions will grow. Insurers that can successfully navigate today’s rate environment while making strategic investments in innovation and customer service will be well positioned to benefit from this growth.

Conclusion: Reshaping the Future of Non-Life Insurance in India

The estimated 8% to 10% increase in India’s non-life insurance business is part of a broader trend towards sustainable pricing as reinsurance volatility persists worldwide. As Indian insurers shift their strategy with increasing reinsurance premium expenses, geopolitical tensions, and catastrophic loss events, they are attempting to maintain financial resilience.

While the increase in prices will pose short-term challenges to insurers and policyholders, they also open up an opportunity for more sustainable underwriting, improved risk management, and creative product development. With the context of future-oriented regulation and increased use of technology, the industry is well-positioned to reinvent itself as a more profound and future-proof industry.